Navigating IMM with SILab Ukraine

Since 2022, Impact Europe has been supporting the Ukrainian Social Venture Fund (USVF) set up by SILab Ukraine. It was one of the first impact funds set up within the framework of our EU-funded market building work, and has supported numerous social entrepreneurs over the last -very challenging- years. Throughout this process, SILab has been developing an IMM system of their own that can help inform both their future decisions as well as those made by their investees.

Interestingly, IMM plays a big role in how the USVF not only picks new portfolio enterprises, but also in how it approaches them.

SILab Ukraine and its Ukrainian Social Venture Fund (UVSF) essentially have two ways of recruiting new portfolio companies. One entry point is by participating in one of their incubation and acceleration programs. These intense educational offerings culminate in pitching sessions, whereby the best evaluated participants can continue their development by receiving financial support. On top of this, SILab Ukraine also release open calls to directly find applicants for their financial support programs. The applications and the information provided by applicants form the basis of an elaborate process of selection, training and due diligence that precede their eventual approval.

It is worth noting that this is process that has evolved over time, and has inspired a learning process for both the fund and its investees. The Ukrainian Social Venture Fund launched during a volatile period for the entire country, which initially took its toll on the IMM side of the operation. As the need for support was so large and acute, a decision was made to make the due diligence and screening phase lighter and more colloquial. By simplifying the application process, the fund could more easily supply capital where it was needed the most. In a sesne, the supported organisations had one overarching KPI in these early war months: keeping their head above water while adapting to a new reality.

However, it didn’t take long for SILab to learn that IMM would play a vital role in their future actions, and that more knowledge was needed, both for their fund to show its viability and additionality, and for the investees to help strengthen their business proposition.

Collaborating on an Impact Strategy

The gist of the work is done during the first step of the process, which consists of forming an impact strategy and setting corresponding objectives. It is worth noting that for many of the entrepreneurs that SILab Ukraine works with, the framework of social entrepreneurship is new and unknown. This means that any work on formalizing impact measurement and management systems is essentially a process of education and training for the applicants.

When they engage with SILab and its fund through an acceleration or incubation program, this learning journey is the offering, with financial support being an extra motivation to work towards. When they reply to an open call, a similarly intensive course is given to participants that are shortlisted. While only a select few organisations will eventually receive funding, this non-financial support can prove equally crucial in reinforcing different Ukrainian entrepreneurs.

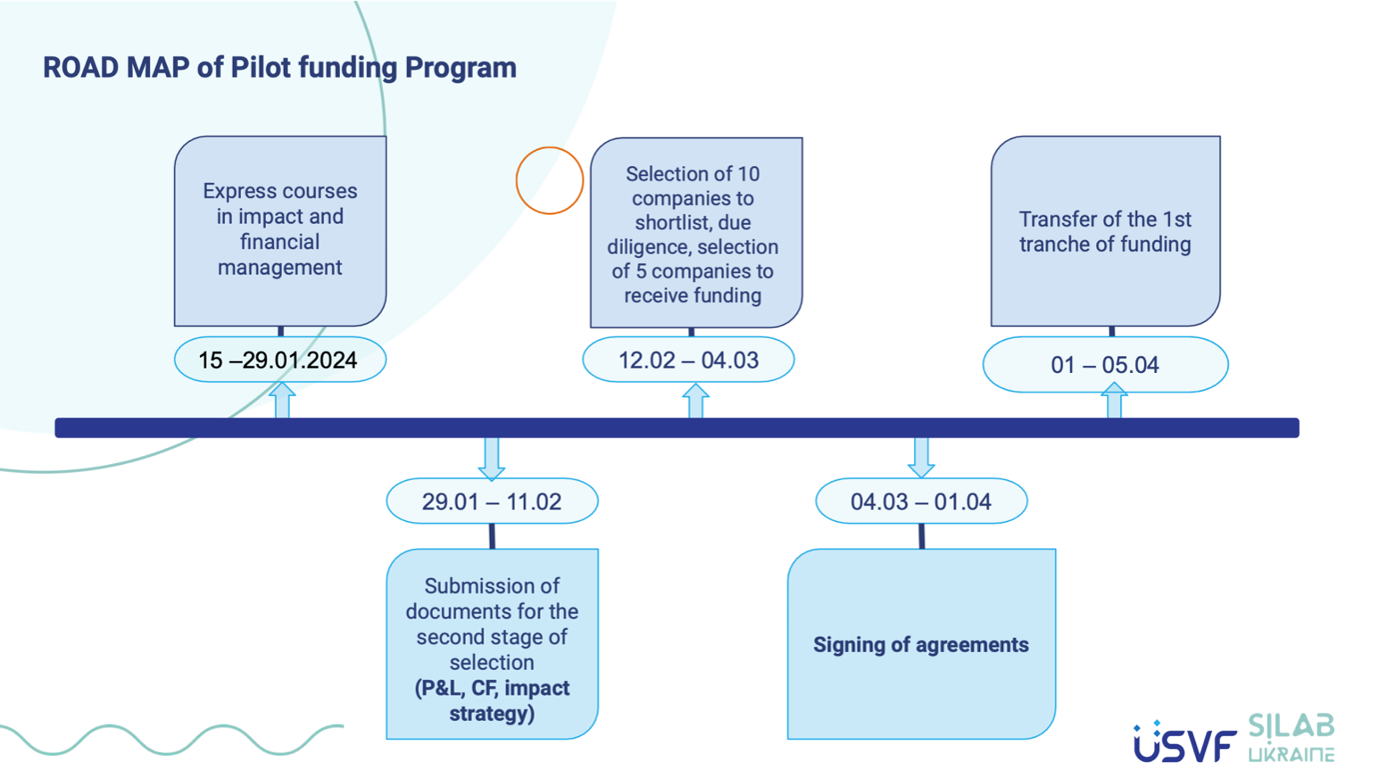

Taking the opportunity of a recent call for proposals, the journey looks a bit like this: applicants hand in their applications, a first screening for elegibility is done, after which a pre-selection of about 20 companies take part in an express course on IMM and financial management. After this, more detailed due diligence is done to whittle the group down to a shortlist of 10 companies, five of which eventually receive funding.

The first step here is quite vital. Crucially, both the incubation programs as well as the bootcamps offered by SILab train investees in developing their own theory of change and formalizing it as a part of their business model. Applicants are guided throughout this process, which has them create a problem tree as well as a solution tree, while also mapping the most important stakeholders in their mission. All this information is gathered in order to start building a first indicator plan, typically with the aim of measuring changes over a period of one year or two years, before being re-evaluated. This corresponds with a lot of the work in steps 1 through 3 in our own IMM guide, which has inspired the content of these educational moments greatly.

To make the resulting plan formed by the investee more visual, SILab also asks candidates to summarize all this information in a matrix that contains both beneficiaries, desired outcomes and indicators used, as well as information about the data collection methods and frequency. Benchmarking, too, is a crucial part in this process, as SILab trains their future investees in drawing up meaningful benchmarks in their sector that will serve as a cornerstone in discussing any of their future numbers.

Even if it is undoubtedly impactful to train eligible applicants in these matters, a choice still needs to be made when it comes to who receives actual financial funding. During the deal screening phase, applicants are evaluated based on a scoring matrix that includes their financial statements, business models and impact strategies, many of which have been created in collaboration with the fund and its team members:

Criteria | Weightage |

Financial activity / stability - The financial model of the company demonstrates the potential for financial stability and further development. (15 points) | up to 20 points |

Business model - The business model of a company is a model with proven profitability and market opportunities and can be scaled to other cities and regions of the country or globally. The company has a business plan with a realistic forecast for the company to achieve a certain level of profitability. The company has a product/service/program already in the market. | up to 20 points |

Team - The company has an enthusiastic team of founders and employees (at least 3 people) who are invested in the success of the project, are open to mentoring, and are interested in the development of the company. | up to 15 points |

Impact - The company should either have a formalized impact mission (goal) or have intention and be committed to pivot their business model(s) to prioritize social impact efforts alongside the profits and be willing to codify that in governance documents. The innovative approach in the proposed business model, product, or service aiming to solve a particular social problem is a plus. | up to 15 points |

Scalability potential - The business model can be scaled to other cities, regions of the country or globally. | up to 10 points |

Ethics - The company has ethics guidelines and follows ethics norms and principles in how they conduct their business, including in their reporting. | up to 5 points |

Justified funding request - The need for financing is clearly necessary and well justified, planned figures for expenses are realistic. | up to 15 points |

The due diligence process done by the fund is extensive, with several rounds of due diligence. All eligible applicants have to provide their P&L statements for the last two years, as well as statements on their cash flow to complement their impact strategy. The applications are subsequently evaluated by a celection committee, which consists of representatives of key players from the social entrepreneurship ecosystem in Ukraine, as well as representatives of USVF Board. Each member of the selection committee evaluates every social enterprise individually, and the scores are then automatically calculated into a total score sheet, from which a shortlist is chosen. Face-to-face interviews and a last look at the provided information will then feed into a final decision.

Deal Screening for the Fund

All of the above is very much oriented towards capacity building for the possible investees, while ensuring that their businesses are viable and investment-ready. At the same time, SILab also saw the need to formalize their own impact goals as a fund, and to align these with an existing framework. Like many other organisations, they decided to use the UN SDG framework as a way of structuring their own impact as a fund, with a specific focus on employment of vulnerable groups in society, including women, who take on a larger role than usual in wartime.

This has also resulted in a first list of unified impact indicators for the Ukrainian Social Venture Fund, which include the following:

- The number of employees from vulnerable groups, as well as the salary paid to such employees.

- The amount of capital invested into social purposes

- The amount of social events and gatherings organized by the SE.

- The amount spent on the organization of such events.

- The estimated euro equivalent of goods/services provided free of charge to vulnerable groups

As the organisation expands its portfolio, these indicators may become more numerous and complex, but for now, simplicity is a conscious decision. While these indicators form a solid basis for the impact generated by the Ukrainian Social Venture Fund, they are not the Holy Grail in their day-to-day work. Flexibility is a key word in their approach, as there is room for other, more customised indicators, are added in discussion with their investees. This contributes to an atmosphere of co-creating and coresponsibility for the funded activities.

On Reporting and Managing

Back to the investees, now. Once they are chosen to receive funding, they commit to delivering updates and reporting to the USVF on regular intervals, which in practice means at least a full numbers report once per year. Depending on the project, this interval could be as short as receiving monthly updates on the main indicators.

It is worth noting that in rational times, objective indicators typically reign supreme over subjective ones. The current situation in Ukraine, however, is far from normal, as conflict disrupts businesses across the entire country. This has urged SILab Ukraine and its fund to not include a sizeable portion of subjective feedback into their IMM process. In addition to regular reporting via reporting templates, which include financial numbers as well as progress on different impact indicators, they have regular 1-on-1 meetings with their investees in which they urge them to provide feedback about the fund’s support, as well as about the question why certain things happened the way they did. Some example question include:

- What positive and negative things have happened to your organization? What organizational and management lessons have you learned during this reporting period? Please provide a detailed answer.

- Were the commercial and social goals set out in the application for support from the Fund achieved? Please provide a detailed answer.

- What goals and objectives does your company set for the next 3 months?

- What kind of support would you like to receive from the fund and SILab in the future?

- What kind of support from Silab and the Fund has your company missed during the project implementation?

Beyond the general, questions of subjective nature are also asked about individual indicators. Both an achieved or missed KPI for a certain outcome will be subject to a discussion on what was the specific action or event that influenced this result. This subjective feedback is vital in improving the investee’s theory of change, as well as the direct management of the fund.

As with most funds, their journey in IMM is a continous one, that urges them to keep questioning their own decisions, as well as the impact these decisions have on their own efficiency and viability. For SILab Ukraine, any discussion on outcomes and indicators comes with its own lessons, many of which they share during conferences and in their yearly annual reports.