How INGOs can engage in impact investing

You can read the full report How INGOs Do Impact Investing here

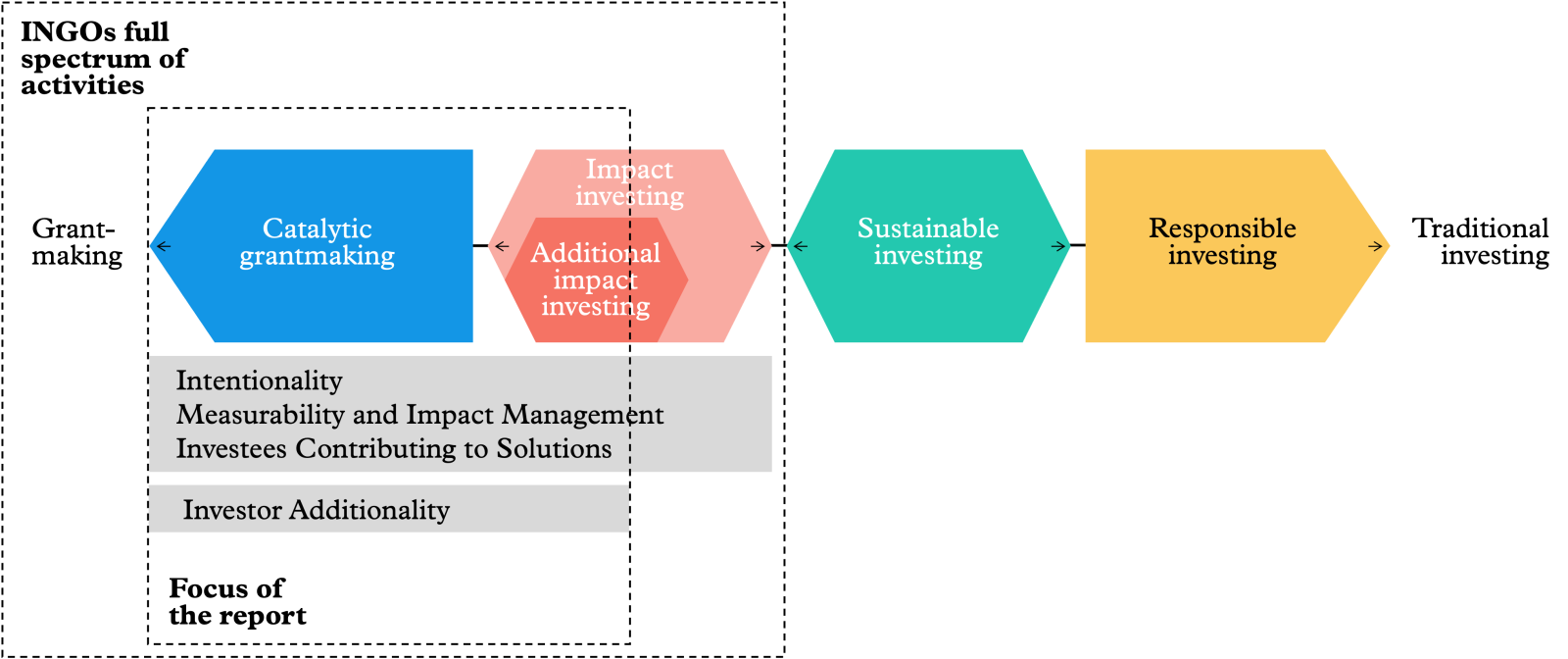

INGOs have multiple avenues to engage in impact investing, with their strategies shaped by their missions, mandates, risk tolerance and organisational capabilities. Yet, they all fit the description of an additional impact investing approach, committing to finding where they can add the most value within the sector. It is worth clarifying that engaging in impact investing does not intrinsically mean investing capital; INGOs can also leverage their versatile roles to act as facilitators, advisors or ecosystem builders.

INGOs consulted for this research do not see engagement in this space as a radical shift from traditional activities, rather as a progressive step that builds upon and strengthens existing strategies. However, successfully integrating this approach requires more than a strategic adjustment; it needs a fundamental transformation within the organisation, involving changes in processes, mindsets and capabilities. Consequently, INGOs must carefully assess their own readiness to engage.

To that end, it is essential for INGOs to start with three key considerations:

- Does impact investing align with the INGO’s goals and objectives?

- If it does, what is the most suitable strategy to engage?

- Does the INGO have the capacity to execute this strategy?

Conducting a thorough internal analysis is a first step to get answers. A focus on assessing the organisation’s capabilities, resources, strengths and weaknesses not only helps identify potential entry points in the field but also spot areas where INGOs can add the most value and pursue additionality.

In practice, this value addition is reflected in two practical approaches: direct and indirect engagement in impact investing. Direct engagement involves INGOs acting as impact investors, either through direct capital deployment or via intermediaries. Indirect engagement positions INGOs as facilitators within the ecosystem: mobilising capital, providing technical assistance and strengthening the broader impact investing landscape.

Direct Engagement

INGOs’ extensive field experience and nuanced understanding of the capital access barriers that impact organisations face can make them well-suited to operate as impact investors. Their role, however, diverges significantly from that of mainstream impact investors; INGOs step in where conventional investing approaches fall short, facilitating interventions that would not otherwise happen.

Part of their unique position also stems from their expectations for financial returns. Their additional approach, which may accommodate below-market rate returns and/or prioritise capital preservation, enables INGOs to channel capital into impact organisations in the ‘pioneer gap’ or ‘missing middle’ (organisations needing funding between $100,000 and $1 million). Some INGOs already active in impact investing target market rate returns, but they are a minority. In fact, a 2018 survey by the Impact Investing Network found that only 24% of the 29 respondents reported seeking market returns .

Direct engagement represents an effective approach for bridging substantial funding gaps. INGOs can deploy different financial tools, depending on their resources, targeted gaps and pertinent legal frameworks. Ranked in this report by their level of complexity, the most commonly used tools in this context include: A) repayable financial instruments within programmatic activities, B) microfinance, C) investing through intermediaries and D) setting up an impact investment vehicle.

Repayable financial instruments within programmatic activities

INGOs have increasingly adopted repayable financial instruments within their programmatic activities as a strategic means to amplify their impact. Deploying loans or equity has not only proven effective in meeting specific funding needs of investees, it also enables them to work on their-long term financial sustainability and bridge the gap between grant funding and repayable capital.

This approach has been compelling for those INGOs whose mandate and organisational structures do not accommodate more sophisticated financial vehicles, such as impact investment funds or outcome-based finance. By broadening their financial toolbox, they can develop more nuanced programs that support impact organisations at various stages of development, from initial incubation to full-scale operations, ultimately increasing the quality of their services.

To better support impact organisations throughout their lifecycle, INGOs may adopt a phased approach in their strategies. In the early stages of ventures, they often establish incubators or accelerator programs that combine essential capacity-building, technical assistance, mentorship and investment readiness with financial support, mostly in the form of grants. These programs help ventures professionalise while allowing room for testing and de-risking ideas. As ventures progress, INGOs may consider transitioning to repayable instruments to better address their evolving financing needs.

Microfinance

INGOs are increasingly incorporating microfinance activities into their impact investing strategies to address a critical gap in access to financial services. While there is a diversity of microfinance models, the subset Impact Europe classifies as impact investing pertains specifically to microfinance services targeted at impact organisations and/or underserved segments such as Micro, Small and Medium-sized Enterprises (MSEs) or disadvantaged individuals, among others . Microfinance institutions provide localised financial support through small loans to MSMEs. They do this to fill a gap created because public and commercial banks are often reluctant to lend to smaller businesses, particularly those operating in disadvantaged areas or serving vulnerable populations, due to perceived risks.

The approaches that INGOs adopt to participate in microfinance vary. Many make investments in microfinance institutions (MFIs), providing the funds that such institutions need for growing their lending operations to reach more underserved clients. Integrating microfinance services into INGOs' programmatic activities is also a common approach, often carried out in partnership with local organisations, to provide financial services such as small loans, savings accounts and insurance to marginalised populations. A few INGOs take the extra step of establishing their own microfinance institutions, either independently or in partnership with local stakeholders.

Investing through intermediaries

Although INGOs have a vast network of organisations that could benefit from their direct capital deployment, those new to the concept of impact investing often opt for investing through experienced intermediaries as a starting point. Partnering with intermediaries is a prudent strategy for INGOs facing one or both of the following circumstances: 1) They want to amplify their impact but are restricted by mandates that prevent direct investments; 2) they seek to allocate capital efficiently without the need to build in-house investment capabilities or take on the complexities of sourcing and evaluating investment opportunities independently.

Additionally, a key benefit of working with intermediaries is risk mitigation. Direct investments in impact organisations can be challenging due to the high-risk nature of early-stage ventures or the volatile environments in which they operate. Intermediaries can help INGOs manage these risks by providing expertise and experience in selecting and managing investments, ensuring that capital is deployed effectively to support recipients in achieving the intended impact.

INGOs with experience in impact investing often choose this strategy as an effective way to expand their efforts.

Setting up an impact investing vehicle

One of the most sophisticated approaches to engage in impact investing is setting up an impact fund vehicle. This strategy is often adopted by INGOs that initially engaged in impact investing through intermediaries and now have a dedicated, robust team with financial and impact expertise.

INGOs that have pursued this strategy have often created separate vehicles to distinguish their investment activities from core charitable work, thereby protecting their reputation, managing risks and streamlining investment processes (see the case of Ayuda en Accion below). This allows INGOs to enter an ongoing process wherein they can build internal capacity and strategically determine how impact investing complements their core functions.

The first step for INGOs using this vehicle is to establish a clear investor thesis and impact strategy. Consulted INGOs that took this option built their impact fund vehicle specifically to bridge the capital shortages that high-potential impact organizations face, which are often hindered by inadequate ticket sizes, unfavourable financial return conditions or high-risk profiles. The primary goal is therefore not to disrupt the market but to address these capital gaps effectively.

The benefits of this approach are significant: setting up impact fund vehicles allows INGOs to streamline and better manage the capital they deploy. By managing investments directly, INGOs can align their investments more closely with their mission and accelerate decision-making. With no other parties involved, interactions are simplified between the INGO and the supported impact organisations. However, this direct approach also has a downside for capital recipients, as it might limit their opportunities to build relationships with local stakeholders, such as banks, which are important for securing additional funding and fostering long-term success.

This approach also has an impact for INGOs, which often face hurdles in securing capital for their investments, whether through their own funds or external fund managers. Most of them concentrate on the missing middle, and these investments are typically high-risk; they require patient capital with long investment horizons, often extending beyond 10 years, and may offer returns below market-rate. Targeting the missing middle also demands careful segmentation and adaptability to diverse market conditions across different countries, which can impact the fund’s liquidity or the ability to attract investors. Yet, the 2018 INGO Impact Investing Network survey supports this approach: the investments reported by the 45 survey respondents ranged from $10,000 to $20 million, with an average investment size of $702,500 , showing alignment with the ticket sizes typical of the missing middle, $100,000 to $1 million.

Indirect engagement

Alongside providing capital, INGOs have increasingly taken on an indirect role in impact investing by acting as key partners to impact investors. They help de-risk investments in two ways: 1) Non-financially, through capacity building and technical assistance activities, both of which enhance the operational effectiveness and strategic positioning of impact organisations; 2) Financially, providing first-loss grants or guarantees.

These two roles demonstrate that INGOs are not always required to master the financial complexities of investment structures to engage in impact investing. Instead, INGOs can effectively partner with experienced impact investors to handle these complexities, enabling them to focus on their core competencies: generating and sustaining impact in vulnerable contexts, leveraging their field experience and network.

Capacity building and technical assistance

INGOs can add value to impact investments through capacity building activities and technical assistance. Their unique value lies in their ability to support both supply and demand, not only benefiting the organisations they support but also impact investors and other stakeholders involved in tackling specific challenges.

In working with impact organisations, local institutions and private actors, INGOs provide a broad range of non-financial support, including capacity development and training — typically funded by donor programmes — as well as assistance with business plan creation, impact measurement and management, fundraising and scaling operations. Given their extensive experience in the field, INGOs have developed frameworks that measure both social and financial return on investment, creating a transparent and accountable impact investment pipeline. INGOs screen organisations in similar ways to impact investors. When organisations are not yet investment-ready, or are still in the early stages of development, it makes them particularly vulnerable, and placing them in the so-called "valley of death." In their efforts to bridge these gaps, INGOs deliver substantial non-financial additionality, enabling impact organisations to become more investment-ready and supporting their path to sustainable growth.

The additionality component is still present when INGOs partner with impact investors, especially when the target population is perceived as hard to reach or the region is considered too risky. When impact investors lack comprehensive understanding of local environments, yet still aim to minimise risks, INGOs can jump in as the best partners due to their understanding of local environments. Acting either as advisors or service providers, on a case-by-case or opportunistic basis, their technical assistance focuses mostly on impact measurement and management; they also source deals and support in balancing positive impact and financial returns .

INGOs can also provide technical assistance to other capital providers, particularly when they partner with established microfinance institutions to enhance their efficiency, market presence and integration of digital financial solutions that support environmental sustainability. A prime example of this is Oxfam Novib’s work in advancing green inclusive finance in Sub-Saharan Africa. This work supports microfinance institutions to deploy digital financial solutions aimed at increasing access to renewable energy products and climate adaptation resources. By supporting MFIs in integrating digital services, Oxfam Novib enhances financial inclusion for underserved communities, helping them to access environmentally sustainable options . This approach not only builds climate resilience but also addresses critical gaps in the provision of affordable, clean energy and other green resources in vulnerable regions.

Mobilising capital

In preparing local organisations for investment and operational effectiveness, INGOs are making significant efforts to help them mobilise capital. Their indirect engagement in impact investing often includes acting as funding facilitators, ensuring that capital is channelled effectively toward such high-impact initiatives by bringing together different stakeholders, whose expectations for returns and impact often vary.

"We do not intend to become a huge financial player ourselves, but rather a facilitator to connect different actors and to support them in filling the gap for the businesses in the so called ‘’missing middle’ until they are ready to be invested by more commercial oriented impact investors." Andreas Müller, Advisor for Financial Inclusion and Private Sector Engagement, Helvetas .

Some INGOs use guarantees to mobilise capital. As a risk-mitigation tool in the development sector, guarantees are a legally binding agreement under which the guarantor (in this context, the INGO) agrees to pay a part or the entire amount due on a loan, equity or other financial instruments in the event of non-payment by the borrower or loss of value in the case of investment . In other words, a guarantee involves a third party agreeing to cover part of the potential losses for investors, which helps make investments in high-impact but higher-risk projects more appealing.

The use of guarantees is strategically valuable for INGOs for several reasons:

- De-risking: Guarantees can reshape the risk-return profile of investments and ease credit barriers for underserved borrowing organisations. This allows organisations to attract additional capital that would not flow to that type of deal without the INGO’s involvement.

- Flexibility: Guarantees are customisable, serving various development purposes: they can support high-impact investments in risky markets, de-risk local banks' loan portfolios for SMEs or transfer risks from local financial institutions to better serve underserved borrowers .

- Blend-able: Guarantees can be integrated into blended finance structures, broadening the pool of capital available for development initiatives and/or for supported organisations

INGOs’ extensive knowledge of local contexts is a significant asset in mobilising capital for high-impact projects in underserved markets. While more mainstream impact investors might be reluctant to target these markets, due to high due diligence costs, particularly in blended finance deals, INGOs can leverage their deep local expertise and established networks to streamline the due diligence process. This capability helps reduce transaction costs and mitigate the risks associated with investing in challenging environments, making such projects more attractive to potential investors.

Read the full report

***

With the financial support of: