5 Steps — How INGOs Do Impact Investing

You can read the full report How INGOs Do Impact Investing here

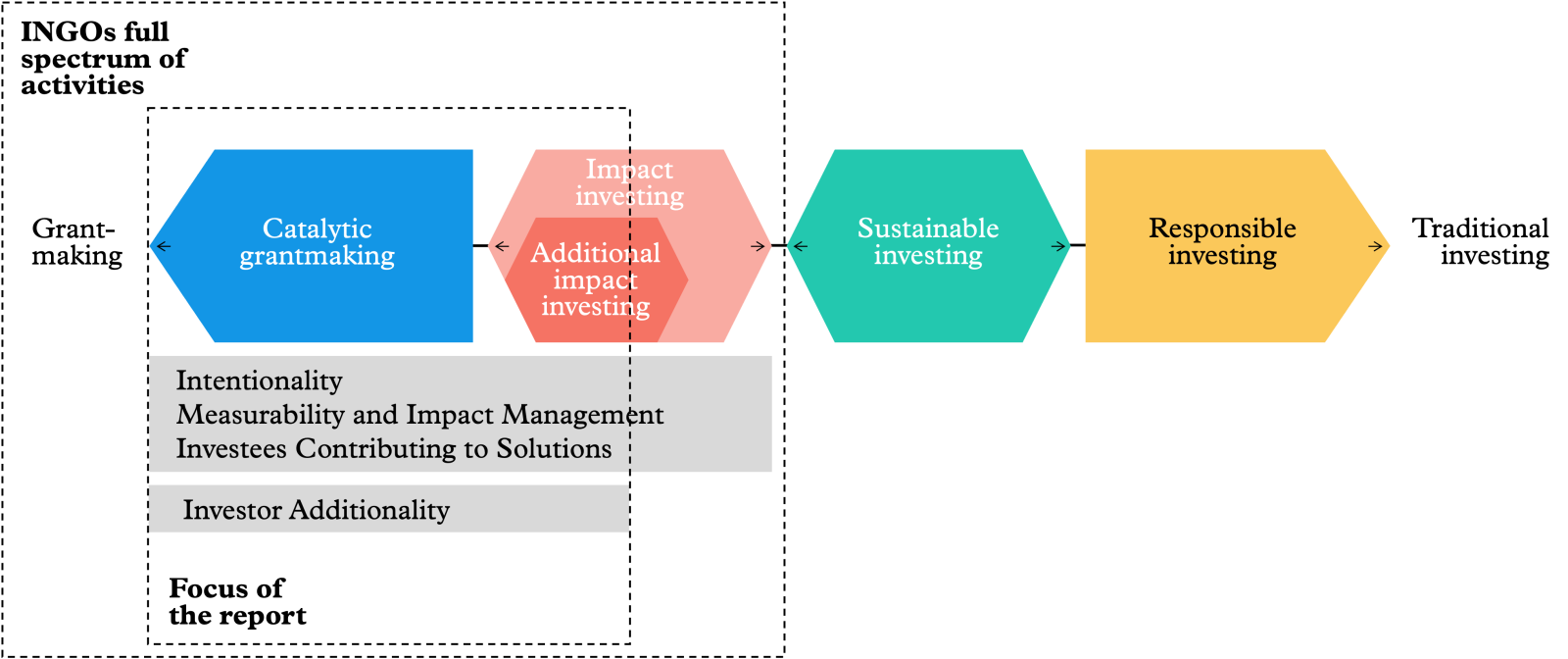

Venturing into impact investing represents an evolution from the traditional way of working for many INGOs. With a variety of strategies available, the idea of getting started might seem overwhelming. The five steps outlined here are designed to provide a clear roadmap, offering guidance for INGOs seeking to begin an impact investing journey.

Impact investing activities can be integrated into an INGO’s core operations or managed through a separate entity. Some elements are more or less relevant depending on the chosen approach.

Step 1: Conduct internal analysis and develop a strong business case

To begin a journey into impact investing, the first essential step is to create a compelling business case supported by robust data and thorough internal analysis. Since this strategic shift may be met with scepticism, INGOs must gather detailed information that highlights the potential benefits of impact investing and assesses the organisation’s capabilities, resources and overall readiness for this transition.

To assist with this process, the INGO Impact Investing Network developed a guiding framework for those who are in their early stages of understanding impact investing and considering their engagement . As INGOs work through this, they can consider key questions such as: What is the primary objective behind developing an impact investing strategy? What are the anticipated results of the impact investing efforts? What resources are available to support this transition?

Step 2: Engage key stakeholders

Having a strong business case will help INGOs onboard a range of internal and external stakeholders necessary for a successful shift.

Securing leadership buy-in, including the board, is crucial to driving an impact investing initiative forward. Their endorsement can not only secure the necessary resources but also align the impact investing strategy with the broader mission. It is equally important that leadership understands the long-term implications of impact investing, as their commitment ensures it becomes an integral part of an INGO’s organisational culture. Reassuring them that this shift will complement, rather than replace, existing values and expertise will help smooth the transition and reinforce the ongoing relevance of the organisation's mission.

Engaging external stakeholders, such as donors and partners, requires clear communication about the rationale for adopting impact investing, as these stakeholders may not immediately grasp why the organisation is entering this space. This is where strong internal leadership buy-in is again vital, as they can help create a strong, clear narrative, and help build a network that supports and understands impact investing goals.

Step 3: Choose the right strategy

Once the vision is set and the INGO’s capabilities are clear, the next step is to define the appropriate strategy. In this report, we’ve outlined various ways to engage in impact investing, accommodating different levels of resources, risk tolerance and expertise. Ultimately, each INGO should choose the strategy where it can provide the most added value, ensuring that supported organisations and target beneficiaries remain at the core of their efforts.

Whether the approach involves direct or indirect engagement, it is crucial to formulate a clear, long-term strategy that aligns with the organisation’s overall mission. Given that impact investing is a relatively new path for many INGOs, it is natural that strategies may shift over time; testing different models is part of the process. Ultimately, the goal is to find the approach that maximises impact without compromising on core values.

Step 4: Build the right team

Impact investing may be a new domain for many INGOs, but INGOs might already have staff with relevant backgrounds in finance. Complement these existing capabilities by hiring experts with experience in impact investing, financial strategy and market analysis. Setting up trainings and capacity building will ensure teams are fully prepared to manage and execute impact investing strategies.

The capacity building required can be significant. Experienced INGOs like Save the Children have invested considerable effort in collaborating with their country offices to explore how various aspects of their operations might be supported through impact investments and other innovative finance mechanisms. Skills such as designing a sustainable business model, evaluating market fit, understanding competitive advantage and pitching investment ideas are not typically within the traditional INGO skill set. Consequently, it took time to develop a robust pipeline of viable investment opportunities .

Given that developing these skills internally is a long journey, INGOs might consider working with external consultants who bring specialised knowledge. These consultants can provide immediate expertise and guide teams through the complexities of impact investing, while also facilitating learning and knowledge transfer within organisations.

Step 5: Start small and build gradually

An impact investing journey can start with manageable investments. INGOs can use internal resources or existing initiatives to pilot approaches and gain experience. Starting small allows INGOs to test and refine strategies, build a track record and understand the different ways they can engage in impact investing. Gradual scaling will help mitigate risks and ensure that INGOs can adapt and grow impact investing activities over time.

Equally important is the opportunity to learn from people and organisations already active in the field. Practitioner communities are a source of insights and guidance. For example, Ayuda en Acción has been one of the early funders of the Fondo de Fundaciones initiative, which connects 40 foundations, to provide a platform for INGOs exploring impact investing through real-world applications. Similarly, Oxfam’s Impact Investing Lab facilitates internal coordination and collaboration with other offices, creating a hub for sharing knowledge and resources. Engaging in such initiatives is a great opportunity to learn from peers and adopt best practices.

Read the full report

***

With the financial support of: