The Unique Edge of a Twofold Strategy

I. Introduction

In a world where sustainable finance is increasingly in focus, INOKS Capital stands out for its unique blend of impact and responsible investing. By aligning its practices with key EU frameworks like the Green Deal, INOKS Capital showcases how private finance can amplify public budgets, turning ambitious policy goals into measurable social and environmental outcomes.

Founded in 2003 as a traditional commodity trading advisor (CTA), the firm pivoted under CEO Nabil Mark’s leadership. Drawing on his experience in West African agricultural markets, Nabil introduced an 'activist funding' strategy, combining financial and non-financial support to smallholder farmers and other investees. This approach has become central to INOKS Capital's model, enhancing sustainability while delivering strong business results.

INOKS Capital’s evolution mirrors broader trends in ethical investing. As a 2010 signatory of the Principles for Responsible Investment (PRI), the firm integrated ESG principles early on, naturally progressing into impact investing to align financial returns with meaningful social benefits.

Relevance to Policy Development

The rise of sustainable finance brings a growing need to clarify the distinctions between sustainable, responsible and impact investment strategies. INOKS Capital provides a concrete example of how these approaches differ and intersect, highlighting where responsible investing transitions into impact investing. This clarity is critical as policymakers shape frameworks to guide and encourage capital flows into sustainable initiatives.

Furthermore, impact investing is often perceived as riskier, with lower financial returns, especially in areas like social equity or inclusion. INOKS Capital challenges this notion by demonstrating how a dual strategy — balancing responsible and impact investing — can optimise a portfolio's risk-return profile while delivering measurable impact.

By bridging these gaps, INOKS Capital serves as a valuable case study, offering inspiration for policymakers and investors to design sustainable finance strategies that combine financial performance with positive social outcomes.

II. Leadership and Vision

As impact investing gained momentum —with the European direct impact investment market estimated around €80 billion in 2022 — INOKS Capital emerged as a key player in this transformative field. The firm's dedication to sustainable finance is evident through its invitation to participate in the Design Team for the Agriculture Impact Performance Benchmark, an innovative tool launched by The Global Impact Investing Network (GIIN) in 2023. As one of just 16 agriculture-focused funds to shape this benchmark, INOKS Capital is helping investors more accurately measure and understand the impact of their investments in comparison with others in the industry.

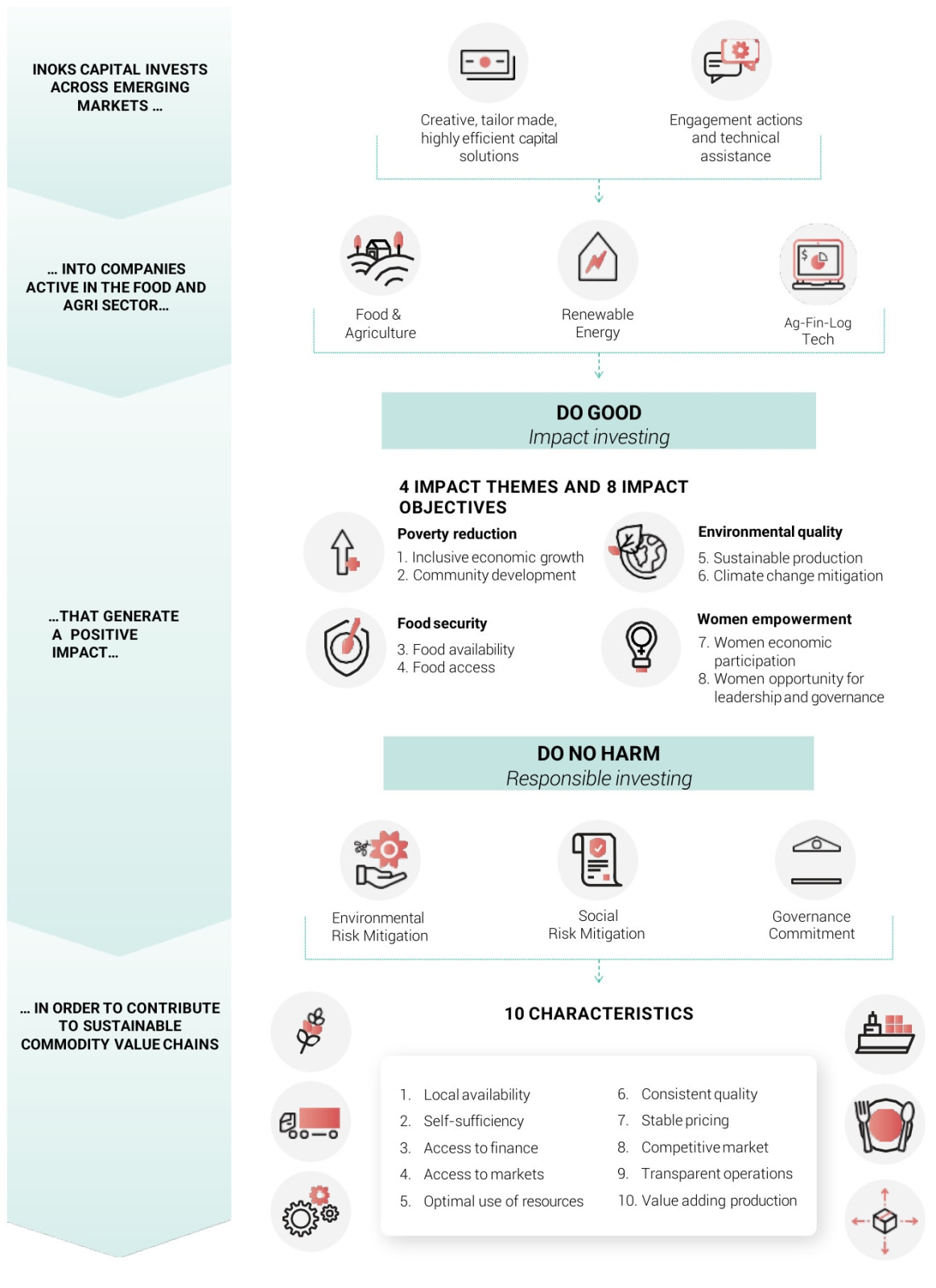

INOKS Capital's commitment to positive change also includes participation in the Net Zero Asset Managers (NZAM) initiative, working toward a net-zero emissions investment portfolio by 2050. Through its twofold Impact ("Do Good") and Responsible ("Do No Harm") framework, applied across all investments, INOKS Capital isn't just keeping pace with the evolving landscape of sustainable finance; it’s actively shaping the future, leading the way toward a more impactful world.

III. The twofold strategy

Both Impact and Responsible Investing lenses are applied across every investment INOKS Capital makes.

Impact Investing

The first element of this strategy is Impact Investing, a commitment to fostering positive change. This focuses on efficient, innovative companies within commodity value chains, specifically those classified as “C class” in the ABC methodology (Companies Contributing to solutions). These companies are selected for their potential to address the world’s most critical sustainability challenges, such as poverty reduction, environmental quality, food security and women’s empowerment, ensuring alignment with the strategy’s goal of driving sustainable and measurable outcomes.

Responsible Investing

The second element, Responsible Investing, addresses the potential adverse impacts of economic activities on the environment and society. INOKS acts as a vigilant guide on this journey, carefully analysing companies’ risk management practices to identify and mitigate potential risks, using the IFC Performance Standards and Corporate Governance Guidelines to align with industry best practices.

Impact investing and responsible investing are two of the five investor strategies Impact Europe delineated in our recent position paper, The 5 Ws of Impact Investing. The paper, a useful read for those seeking the theory behind INOKS Capital’s practice, reflects the perspectives of European market-building organisations at national and regional levels. while incorporating widely recognised global standards from the Impact Management Project (now hosted by Impact Frontiers) and the Global Impact Investing Network (GIIN).

IV. European Agri-Transition Fund

INOKS Capital’s European Agri-Transition Fund embodies the core principles of impact investing, seeking both financial returns and measurable social and environmental benefits. Supported by a €40 million commitment from the European Investment Fund (EIF) through the InvestEU Equity Product, this fund targets sustainable agriculture across eastern and southern Europe, regions essential to advancing the EU’s Green Deal and Farm to Fork Strategies. By focusing on small and medium-sized enterprises (SMEs), the fund fosters local economic growth while addressing systemic challenges such as food security and climate resilience.

The fund’s structure is key: investments are backed by tangible assets like inventory and sales proceeds, providing stability and minimising risks. This approach not only supports businesses vital to sustainable agriculture but also drives broader environmental and social impact while aiming for competitive financial returns of 9-10%. All investments will meet Article 9 Sustainable Finance Disclosure Regulation (SFDR) criteria, and over 50% of investments seek to be deployed in alignment to the EIF’s criteria for Climate Action and Environmental Sustainability (CA&ES) demonstrating a strong commitment to high ESG standards.

By maintaining a diversified portfolio of private debt investments, INOKS Capital ensures its fund supports a wide range of agri-food businesses that promote resource efficiency and inclusive economic growth, thus contributing positively to local communities. Through this balance of financial performance and impact, the European Agri-Transition Fund exemplifies how strategic investments can catalyse sustainable development, tackling Europe’s most urgent challenges while delivering strong returns.

V. Impact Story

Supporting Women Farmers in Côte d'Ivoire

Côte d'Ivoire, a region known for its agricultural potential, was selected by INOKS Capital due to its strategic importance in West Africa’s food security landscape. INOKS Capital identified an opportunity to make a significant impact by investing in the local rice industry, which is crucial for both economic stability and food availability in the region. The country has a robust agricultural sector but faces challenges such as limited access to finance, technology and markets for smallholder farmers. INOKS Capital focuses on companies that have the potential to drive significant social and environmental impact.

In rural areas in Cote d’Ivoire, where agriculture is a main source of income for most people, local rice processors faced the challenge of meeting the demands of a growing community of farmers. That’s when INOKS Capital stepped in with a transformative $7.5 million investment through collateralised private debt. This wasn't just about providing funds; it was about empowering change at every level. The investment facilitated the formation of 80 cooperatives, uniting around 50,000 farmers. With these resources, farmers experienced a 2.5x increase in yields, leading to higher incomes and more stable livelihoods. As rice processing scaled locally, this had a meaningful impact on local food availability, stabilisation of last-mile pricing and upskilling in local employment, demonstrating how strategic funding can create lasting community wide impact.

But INOKS Capital's influence extends far beyond rice production. In the cocoa sector, INOKS partnered with TAFI, a women-led cocoa processor focused on local value addition and women empowerment. Through collateralised private debt, INOKS supported TAFI in enhancing cocoa quality and introducing sustainable practices; these improvements helped TAFI secure a Rainforest Alliance certification, which opened up new markets. As a result, farmers — many of them women — received training in sustainable production, child protection and deforestation prevention, while earning annual premiums that lifted their families out of poverty. The investment allowed TAFI to procure and process certified cocoa beans, which not only improved the supply chain’s sustainability but also added local value to Côte d'Ivoire’s cocoa industry by increasing traceability and local processing capacity.

In another region of Cote D'Ivoire, women rice farmers were struggling with limited access to land, finance and machinery. INOKS Capital saw an opportunity to change that. They facilitated a technical assistance program with a developmental NGO, equipping these women with the tools and training they needed. With machinery tailored to their small plots and new skills in cooperative management, these women began to harvest more efficiently, yielding more rice than ever before. This was more than an investment in equipment; it was an investment in equality, sustainability and a brighter future for women farmers and their communities.

This program has made a tangible difference to INOKS’ investee Socomci, a local rice processing company. By providing essential machinery and training to women-led cooperatives within their investee’s supply chain, this has boosted productivity and yields allowing INOKS’ investee to process and sell more, as well as crucially enhancing incomes for farmers and advancing gender equality in the region.

INOKS Capital’s impact investment is additional because it provides support that would not have been available otherwise. By using collateralised private debt, seeking grants and offering technical assistance, INOKS addresses key gaps in both financial and non-financial resources. This investment is financially additional by offering capital to projects that might otherwise struggle to secure funding. It is also non-financially additional through the provision of technical expertise and capacity-building support, which helps ensure the sustainability and effectiveness of the investment. Through this approach, INOKS aims to bridge financial, social and environmental objectives, with a focus on empowering women farmers in Côte d'Ivoire. By combining these elements, INOKS contributes to fostering a more resilient and sustainable future for farming communities.

Conclusion

INOKS Capital has demonstrated that finance can be a powerful force for good, skilfully intertwining profit with purpose. Their work in Côte d'Ivoire — empowering women farmers, supporting local ecosystems and promoting sustainable practices — attests to the tangible impact ethical investing can have on communities and the environment. Meanwhile, the European Agri-Transition Fund showcases their innovative spirit, advancing global sustainability goals while achieving strong returns for investors.

The firm’s dual approach — "Do Good" through impact investing and "Do No Harm" through ESG — strikes a balance that not only enhances profitability but also drives meaningful change. INOKS Capital has shown that businesses don’t have to choose between impact investment strategies and financial success; they can pursue both.

However, INOKS Capital remains a minority within the broader investment landscape, where many investors are still primarily driven by risk and return. The growing focus on sustainable finance highlights the need to clarify distinctions between responsible, sustainable and impact investing strategies. INOKS Capital exemplifies how these approaches can intersect, with their model clearly delineating where responsible investing transitions into impact investing.

For impact investing to gain mainstream traction, it is critical to address the perception that creating impact comes with a financial trade-off. While this may hold true for some catalytic investments — such as INOKS Capital’s support for East African farmer cooperatives, which prioritises long-term food security, income stability and sustainable agricultural practices despite modest financial returns — their broader portfolio shows that impact and financial performance can coexist.

By employing a twofold investment strategy that balances responsible and impact investing, INOKS Capital highlights how innovative approaches can adjust the risk-return profile of an investment portfolio, making impact investing an attractive and competitive model. Their story serves as an inspiration, encouraging investors and policymakers to embrace strategies that align financial performance with intentional, measurable positive change.

Next steps

For impact investors, spotlighting approaches like INOKS Capital’s can help mainstream finance and policymakers better understand what we do and why it matters. Further research and education can also help shift perceptions, showing that impact investing isn't just about doing good; it’s a viable, sound financial choice for the future of responsible investing.