NGOs as Impact Investors

Andreas Müller and Siham Boukhali, both Financial Inclusion Advisors at Helvetas, share their expertise on NGOs as impact investors. This knowledge is derived from their joint work in this area with other international NGOs - ACTED, Ayuda en Accion, People in Need and Welt Hunger Hilfe - as members of Alliance2015, a strategic network of European non-government organisations engaged in humanitarian and development action.

NGOs moving into impact investing are not that common. Why? What are some of biggest hurdles to overcome for NGOs to enter this space?

This assumption is a common misconception that most of us would not agree with. Many of us (within the Alliance2015) as well as other peers across Europe and globally are active in the field of impact investment. Often, however, we are perceived by impact investors as charity organisations focused on traditional development – or only humanitarian work. We’ll be present at Impact Week to change this perception and bring our skills and expertise in applying innovative finance solutions.

Our strengths reside in our deep knowledge of regions and industries (or value chains) where the potential investee operates (i.e., the typical target of an investment firm). Given our knowledge of countries in the Global South/East, there are opportunities to provide advice to impact investors and guide their investment strategies towards the achievement of poverty reduction and maximising sustainable impact.

Experiences and research have shown that impact investors often lack comprehensive understanding of local environments, while being very focused on minimising risks. Understanding and navigating local environments is our strength, and when we join forces with the private (and, ideally, also with the public) sector we are able to greatly scale our impact.

What are the goals of Alliance2015 in impact investing?

Our overall aim is to maximise the effect of impact investments to generate sustainable benefits for vulnerable and marginalised communities that we work with in the Global South.

It is estimated that to achieve the 2030 SDGs, over 4 trillion dollars are needed to close the global financing gap. The finance needed is only 1% of global wealth (UNDP, 2024). INGOs have a major role to play in closing this gap where it matters the most.

Specific objectives are:

- To engage with and facilitate the best use of impact investment as part of the systemic approach applied in our working areas and partner countries.

- To access alternative financing mechanisms to pursue our mission to generate sustainable impacts for poor and disadvantaged groups and our planet.

- To ensure that impact investment can be used to stimulate sustainable and inclusive economic development in the contexts where we work, while also generating positive climate adaptation and mitigation impacts.

- To utilise our in-depth knowledge and experience in working with communities in the Global South/East (and thereby also having gained a precise understanding of their challenges in these different contexts), to direct impact investment resources to where most impact can be achieved in a sustainable way.

- To scale impact by mobilising private capital towards development-oriented objectives.

- To leverage our access to public funding with private capital through blended finance mechanisms, improving impact and returns while reducing risks.

Can you share examples of how this works in practice and which impact investing instruments work well for NGOs?

We can offer a range of services, including:

- Technical assistance in areas such as private sector development, vocational skills development, agriculture, WASH, climate change and more.

- Investment readiness and facilitation for start-ups and MSME’s to help them improve their social and / or environmental and / or economic impact.

- Matchmaking and collaborations with the private sector: To bring investors and investees together and to help design and develop various financial instruments to leverage private resources and scale (social) impact.

- NGOs can also act as investors (equities/convertibles) and do so by investing in impactful social enterprises to help them scale their impact.

Beyond these services, the members of the Alliance2015 combined apply a variety of instruments:

- Social impact bonds: With this instrument, investment returns are directly tied to the achievement of specific outcomes, which better reflect our social impact objectives.

- Similarly, Development Impact Bonds mobilise funds towards projects in health, education, agriculture and other areas critical to development in low- and middle-income countries. For example, through its impact bond platform, Acted has raised over €43 million since 2005, from impact and solidarity investment funds and has allocated this money towards various development-oriented projects and programs.

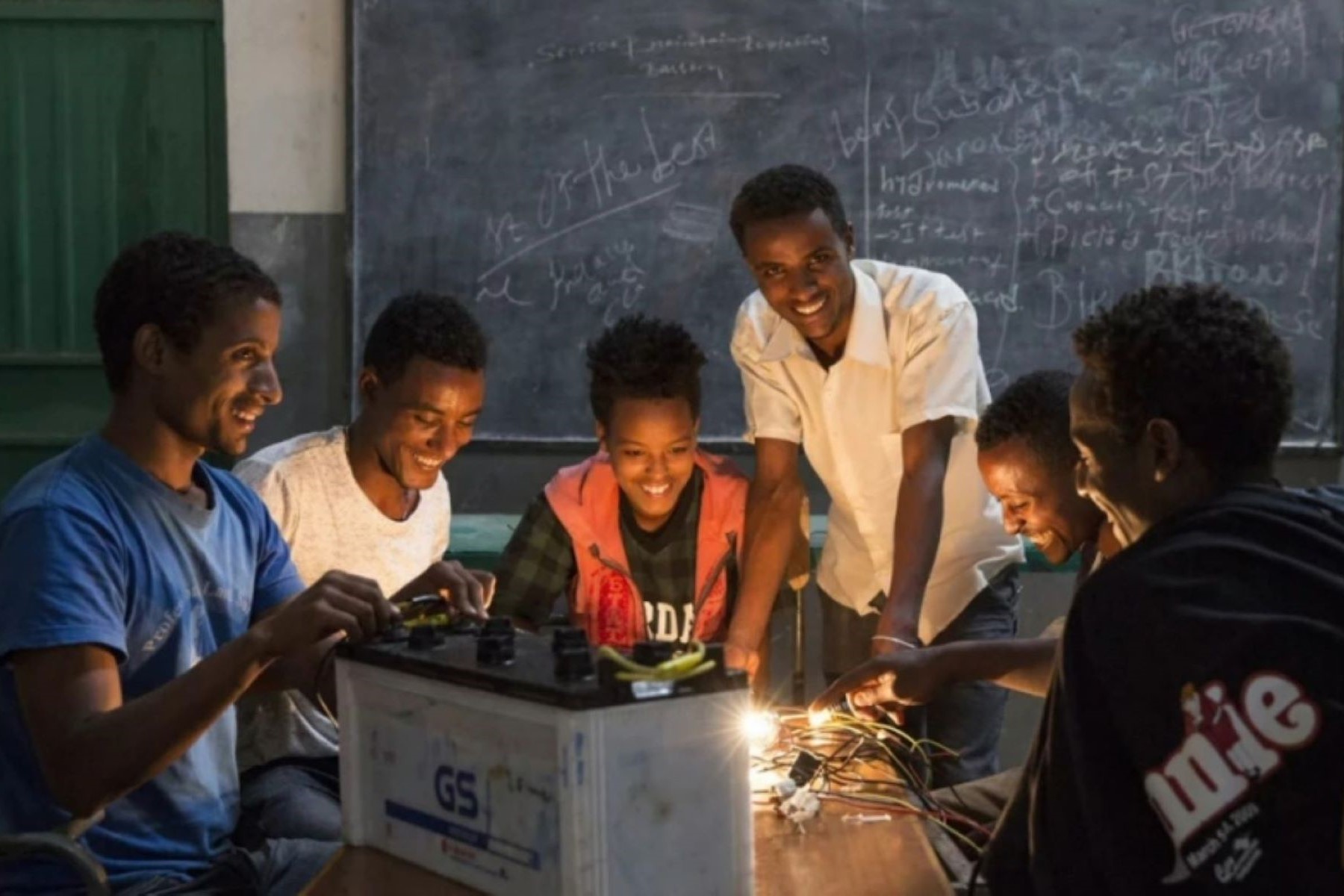

- Results-based finance (RBF) pays for achieved outcomes (e.g., employment). This creates an incentive for partner institutions to go beyond delivering inputs, while also focusing on market needs and subsequently generating impact. Helvetas regularly applies the RBF approach. For example, in the SKY Project in Ethiopia, training providers are incentivised upon successful and gainful employment of their graduates. Through the collaboration with the private sector, training content is adjusted to the market needs and shortages in skilled labour forces are tackled.

- Impact/outcome verifier: As impact specialists used to conducting project evaluations and closely monitor our activities, we are experienced in verifying and evaluating impact targets.

- Equity Investments: NGOs have a different return expectation, a long-term commitment, and can have a higher risk tolerance than other impact investors, therefore making it possible to invest in (social) businesses in contexts which can be perceived as not suitable for other investors. Welt Hunger Hilfe, for example, is investing in the start-up “Toothpick” (bio-herbicide innovation) in Kenya, and supports its successful scaling across countries in East Africa, thereby increasing the businesses’ social, economic and ecological impact.

- Green bonds are specifically earmarked to be used for climate and environmental projects. They can provide NGOs with access to capital for large-scale projects that might be difficult to fund otherwise. Green bonds accounted for only 0.6% of all bonds issued in the EU in 2014, rising to 8.9% in 2022 (European Environment Agency, 2023).

- Blended finance: In general, blending public and private funds allow the leveraging of private sector capital by de-risking investments, while at the same time focusing on challenging contexts or sectors and applying a pro-poor approach.

- Microfinance: the funding, support or direct ownership of microfinance institutions provides a way for NGOs to support the provision of financial services to the world’s underbanked and unbanked. Acted, for example, owns the Oxus microfinance network, a network of Central Asian microfinance institutions with over 50,000 active borrowers, the majority of whom are female and rural borrowers, and a loan portfolio in excess of €43 million (funded by Micro Investment Vehicles).

- Small-scale infrastructure: investing in sustainable infrastructure in developing countries to improve the quality of life for local beneficiaries while generating positive financial return.

- Crowdlending: the mobilisation of capital from individual retail investors to allocate towards development-oriented projects.

All these instruments and approaches prioritise the creation of sustainable impact, which is our main goal. Additionally, they are designed in a way that is attractive for funders to invest in contexts or sectors that they would not normally invest in due to risk aversion.

The organisations of Alliance2015 are based in different European countries and work in different geographies. Does national or regional context matter when it comes to engaging in impact investing?

We don’t necessarily work with the same donors, but we have the same objective of sustainability of impact. In a globalised and digitalised world, national or regional contexts matter less and less – especially in well-connected regions, such as Europe, where we can easily work together towards our common goal. But more important than the location of our European head offices is the fact that we work in the same or very similar contexts in the Global South/East und share an in-depth understanding of the challenges and needs of the communities we work with.

What’s the benefit of you all working on this together, as part of a broader coalition?

Greater impact, pooled resources, joint knowledge and larger outreach. All of us have well-established networks in our “home” countries and can leverage these to boost other efforts and joint endeavours. Additionally, we are at different stages when it comes to impact investing and can learn from each other’s experiences.

You’ll be at Impact Week in Bilbao in November to delve deeper into the topic of NGOs in impact investing. What’s your one message to other NGOs?

INGOs are impact specialists with vast and well-established networks and context understanding. We hold valuable competencies to complement impact investors in their business of investing in impactful social businesses in the Global South/East.